Physics Wallah has emerged as one of India’s fastest-growing edtech brands, trusted by millions of students across the country. For investors tracking the startup and unlisted markets, the key questions are: Is Physics Wallah a good buy? What could be its share price targets over the next five years after a potential IPO?

In this article, we break down Physics Wallah’s business model, revenue growth, risks, market position, and long-term expansion potential. We also provide data-driven valuation and share price forecasts for 2026–2030.

Table of Contents

- 1. Should You Buy Physics Wallah?

- 2. Physics Wallah Stock Price Forecast: 2026–2030

- 3. Interactive Investment Calculator

- 4. SWOT Analysis & Risk Factors

- 5. Is Physics Wallah Stock a Good Buy?

- 6. Why Physics Wallah’s Share Price May Lag

- 7. Physics Wallah Share Price Target 2026

- 8. Physics Wallah Share Price Target 2027

- 9. Physics Wallah Share Price Target 2028

- 10. Physics Wallah Share Price Target 2029

- 11. Physics Wallah Share Price Target 2030

- 12. Physics Wallah Stock Price Prediction & Investment FAQ

- 13. About Physics Wallah

- 14. How Physics Wallah Earns Revenue

- 15. Conclusion & Future Outlook

1. Should You Buy Physics Wallah?

Key Growth Factors:

- Strong brand + massive student base driving steady demand

- Hybrid model scaling fast (online + offline centres)

- Profitability remains the biggest trigger for upward re-rating

- Valuation already high, so upside depends on margin improvement

- Moderate long-term growth, not a high-risk multibagger

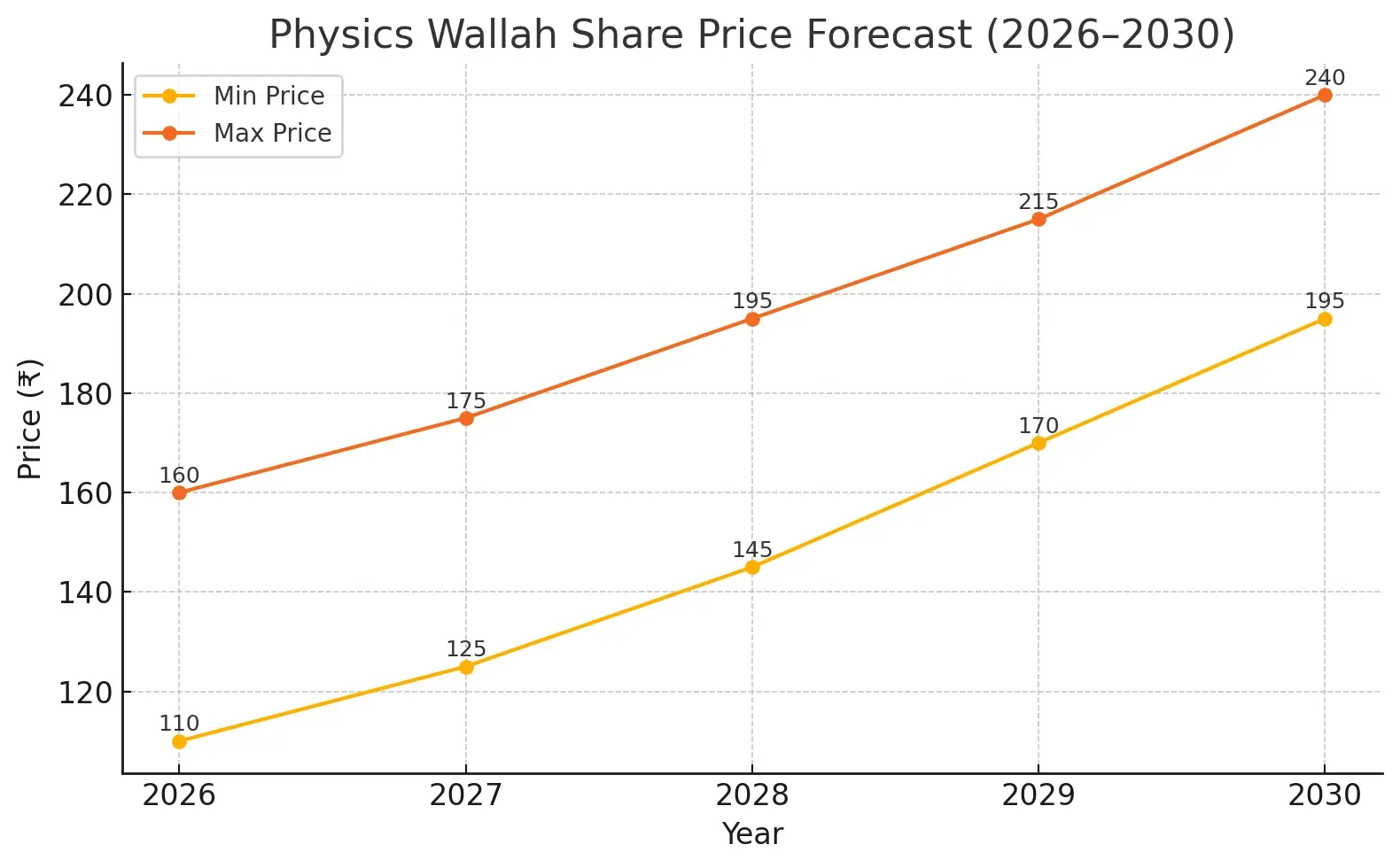

| Year | Min | Max |

|---|---|---|

| 2026 | ₹110 | ₹160 |

| 2027 | ₹125 | ₹175 |

| 2028 | ₹145 | ₹195 |

| 2029 | ₹170 | ₹215 |

| 2030 | ₹195 | ₹240 |

2. Physics Wallah Stock Forecast Summary

Physics Wallah has a promising long-term outlook, supported by its large student base, expanding hybrid model, and strong brand trust. Profitability remains the key trigger—once margins improve, PW could deliver steady long-term returns while remaining a moderate-risk growth stock.

Min Range (2026–2030): ₹110 – ₹195

Max Range (2026–2030): ₹160 – ₹240

3. Investment Calculator

₹0.00 Present Value: ₹0.00 Total Interest: ₹0.00 Future Value: ₹0.00Investment Calculator

4. Strategic Risks & SWOT – Physics Wallah

Strengths

- Strong brand trust with millions of students and parents.

- Low-cost course model disrupting premium-priced competitors.

- Massive digital reach: 98M+ YouTube subscribers.

- Rapid offline expansion with 300+ centres nationwide.

- High revenue growth and strong unit economics in key segments.

Weaknesses

- Heavy reliance on founder-driven content & identity.

- Increasing operational costs from offline expansion.

- High competition from BYJU’S, Unacademy, Vedantu.

- Limited global presence vs international edtech giants.

- Regulatory sensitivity in education sector.

Opportunities

- Huge untapped Tier-2 & Tier-3 markets.

- Expansion into higher education, UPSC, GATE, govt exams.

- Growth in hybrid learning (online + offline).

- Monetizing brand: books, merchandise, test series, apps.

Threats

- Edtech slowdown or funding winter.

- Price wars with major competitors.

- Regulatory changes impacting online learning.

- Over-expansion risk of offline centres.

- Economic slowdown reducing student spending.

5. Is Physics Wallah Stock a Good Buy?

Bull Case – Why Physics Wallah Could Rise:

• Explosive revenue growth (₹772 Cr → ₹2,887 Cr in 2 years) shows massive demand.

• Ultra-low pricing model creates unbeatable value vs high-cost competitors.

• 98M+ YouTube reach gives PW free distribution and lowest CAC in the industry.

• Fastest offline expansion with 300+ Vidyapeeth centres, improving retention & revenue stability.

• Strong founder appeal: Alakh Pandey’s brand trust drives organic customer acquisition.

Bear Case – What Could Hold Physics Wallah Back:

• Offline expansion costs may reduce margins and strain cash flow.

• Heavy dependence on founder personality, risk if focus shifts or execution slows.

• Intense competition from BYJU’S, Unacademy, Vedantu, and new hybrid players.

• Market saturation in core JEE/NEET segment may slow user growth.

• High expectations baked into valuation → risk of overvaluation at IPO.

6. Why Physics Wallah’s Share Price May Lag

Possible reasons for underperformance:

• Slowing edtech demand post-COVID affecting industry-wide growth.

• Rising customer acquisition costs (CAC) as competition increases.

• Low ARPU model limits profitability despite high student volume.

• Execution risk in new verticals like UPSC, GATE, CA, MBA.

• Tough offline competition from Allen, Aakash, FIITJEE.

7. Physics Wallah Share Price Target 2026

Rationale

• Strong brand trust and lowest-cost student acquisition in edtech

• Rapid growth in hybrid offline centers boosting long-term revenues

• Still loss-making, so valuations depend on growth, not earnings

• High volatility expected since the stock is newly listed and in price discovery

• Based on our model, the Physics Wallah share price in 2026 is expected to trade between ₹110 – ₹160

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 133 | 148 |

| February | 128 | 150 |

| March | 110 | 131 |

| April | 125 | 147 |

| May | 131 | 149 |

| June | 110 | 131 |

| July | 124 | 154 |

| August | 136 | 156 |

| September | 110 | 131 |

| October | 135 | 159 |

| November | 127 | 160 |

| December | 132 | 160 |

8. Physics Wallah Share Price Target 2027

Rationale

• Hybrid (online + offline) expansion expected to stabilize revenues as more Vidyapeeth centers mature.

• Improving operational efficiency as scale reduces per-student cost.

• Strong brand loyalty and low-cost customer acquisition, giving PW a durable competitive edge.

• Ongoing digital initiatives expected to improve operational efficiency

• Potential path toward profitability by FY27 if expenses normalize.

• Based on our model, the Physics Wallah share price in 2027 is expected to trade between ₹125 and ₹175

2027 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2027 | ₹125 | ₹175 |

9. Physics Wallah Share Price Target 2028

Rationale

• Stronger revenue visibility as offline centres (Vidyapeeth + Pathshala) scale and reach break-even.

• PW may start showing positive net profit by FY28 if operational costs stabilize.

• Expansion into UPSC, GATE, CA, SSC, Banking could boost high-margin segments.

• Brand trust + large student ecosystem create sustainable long-term demand.

• Possible PE rerating if FY28–FY29 earnings show consistency.

• Based on our model, the Physics Wallah share price in 2028 is expected to trade between ₹145 and ₹195

2028 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2028 | ₹145 | ₹195 |

10. Physics Wallah Share Price Target 2029

Rationale

• By 2029, PW’s offline network (400–500+ centers) may operate at full efficiency, boosting margins.

• Diversified revenue streams (K–12, UPSC, GATE, CA, Govt Exams, Foundation courses) reduce dependency on JEE/NEET.

• Strong potential for international expansion in online learning segments.

• Edtech consolidation may leave PW as the strongest low-cost, high-scale player in India.

• Based on our model, the Physics Wallah share price in 2029 is expected to trade between ₹170 and ₹215

2029 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2029 | ₹170 | ₹215 |

11. Physics Wallah Share Price Target 2030

Rationale

• By 2030, PW could be a fully profitable, mature hybrid edtech company with strong national presence.

• Large alumni base and strong brand loyalty drive predictable annual enrollments.

• Potential expansion into international test-prep & online degree partnerships, adding high-margin revenue.

• Strong cash flows from offline centers + digital products may improve long-term valuation multiples.

• If PW maintains growth discipline, it could evolve into India’s largest affordable education ecosystem.

• Based on our model, the Physics Wallah share price in 2030 is expected to trade between ₹195 and ₹240

2030 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | ₹195 | ₹240 |

12. FAQ on Physics Wallah

Q1: What is the Physics Wallah share price target for 2026?

A: Based on current fundamentals, the 2026 target range is ₹110 – ₹160, depending on revenue growth and early profitability signs.

Q2: Can I buy Physics Wallah shares now?

A: Yes, but only if you’re comfortable with a newly listed, loss-making edtech stock with higher volatility.

Q3: Is Physics Wallah a multibagger?

A: Unlikely in the near term due to high valuation and rising costs. But if PW becomes profitable quickly and scales well, it could deliver strong long-term returns — possibly even multibagger potential.

Q4: Is Physics Wallah good for long-term investment?

A: It can be, if PW achieves profitability, stable cash flows, and scaled offline operations over the next 2–3 years.

Q5: Is Physics Wallah growing?

A: Yes. PW is expanding rapidly across offline centres, online courses, and new exam categories, driving strong revenue growth.

Q6: Is Physics Wallah stock a good buy?

A: It’s a moderate-risk, moderate-return stock. Good for long-term investors seeking steady compounding, not for aggressive traders.

13. About Physics Wallah

Founded: 2016

Founder: Alakh Pandey & Prateek Maheshwari

Headquarters: Noida, Uttar Pradesh

Website:www.pw.live

Overview:

Physics Wallah is one of India’s fastest-growing edtech companies, serving millions of students across competitive exam prep, school learning, and skill development. PW is known for its low-cost, high-quality learning model, massive YouTube reach, and rapidly expanding offline centres, making it a major player in India’s hybrid education space. The company earns through online courses, books, test series, offline coaching, and digital products.

Key Focus Areas:

- Affordable Online Courses: High-quality content at student-friendly prices.

- Hybrid Expansion: Fast growth of Vidyapeeth & Pathshala offline centres.

- Exam Diversification: JEE/NEET, UPSC, GATE, CA, SSC, Banking, K-12.

- Strong Content Ecosystem: Apps, test series, books, recorded lectures.

Mission:

To provide accessible and affordable education using technology and hybrid learning, empowering students across India — especially in Tier-2 and Tier-3 regions.

14. How Physics Wallah Earns Revenue

Physics Wallah generates revenue from multiple banking and financial service streams that support both retail and corporate customers.

- Online Courses: Paid batches for JEE/NEET, UPSC, GATE, CA, SSC, Banking, and K-12.

- Offline Coaching: Revenue from Vidyapeeth & Pathshala classroom centres across India.

- Test Series & Digital Products: Mock tests, study material, doubt-solving tools, and premium app features.

- Books & Printed Material: PW-branded books, notes, and exam modules.

- YouTube & Digital Ads: Monetisation from PW’s large network of YouTube channels.

- Academic Partnerships: School tie-ups and integrated learning programs.

Physics Wallah Key Highlights

🎯 Massive Student Reach: Millions of learners across 200+ YouTube channels.

🏫 Fast Hybrid Expansion: 300+ offline centres (Vidyapeeth / Pathshala) across India.

📚 Strong Product Portfolio: Courses, books, tests, doubt-solving, digital content.

💰 Low-Cost Model Advantage: High volume, affordable pricing → strong market fit.

📈 Rapid Growth: Diversifying into UPSC, GATE, CA, SSC, Banking & skill-based programs.

15. Conclusion & Future Outlook

Physics Wallah is positioning itself as a dominant hybrid edtech player with a massive student base, fast-growing offline centres, and a highly scalable low-cost model. While the company is still loss-making, the key drivers to watch are profitability, cost efficiency, and consistent enrollment growth.

For investors, PW offers a moderate-risk, steady-growth opportunity, with meaningful upside only if the company improves margins and sustains strong execution. If PW turns profitable sooner than expected, it could unlock significant long-term value for shareholders.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial advice. The content is based on publicly available data, and while we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information. Always consult with a qualified financial advisor or professional before making any investment or financial decisions.

Leave a comment

Your email address will not be published. Required fields are marked *