Canara Bank is one of India’s largest and oldest public-sector banks, known for its vast branch network, strong customer base, and steadily improving financial performance. For investors tracking banking stocks, the key questions naturally arise: Is Canara Bank a good long-term investment? Is it undervalued? What is the target price of Canara Bank shares? And is now the right time to buy?

In this article, we break down Canara Bank’s business model, profitability, asset quality trends, risks, and market positioning. More importantly, we provide data-backed share price targets for 2026, 2027, 2028, 2029, and 2030 to help investors understand the bank’s long-term potential.

If you’re evaluating whether Canara Bank is a good buy for the next five years, this in-depth analysis will give you a clear and reliable view of its future outlook and investment prospects.

Table of Contents

- 1. Should You Buy Canara Bank?

- 2. Canara Bank Stock Price Forecast: 2026–2030

- 3. Interactive Investment Calculator

- 4. SWOT Analysis & Risk Factors

- 5. Is Canara Bank Stock a Good Buy?

- 6. Why Canara Bank’s Share Price May Lag

- 7. Canara Bank Share Price Target 2026

- 8. Canara Bank Share Price Target 2027

- 9. Canara Bank Share Price Target 2028

- 10. Canara Bank Share Price Target 2029

- 11. Canara Bank Share Price Target 2030

- 12. Canara Bank Stock Price Prediction & Investment FAQ

- 13. About Canara Bank

- 14. How Canara Bank Earns Revenue

- 15. Conclusion & Future Outlook

1. Should You Buy Canara Bank?

Key Growth Factors:

- Consistently improving asset quality with declining Gross & Net NPA ratios.

- Strong loan book expansion across retail, MSME, and agriculture segments.

- Rising profitability supported by healthy Net Interest Income (NII) and better credit cost management.

- Government backing and capital support, improving long-term stability.

- Rapid digital transformation enhancing operational efficiency and customer reach.

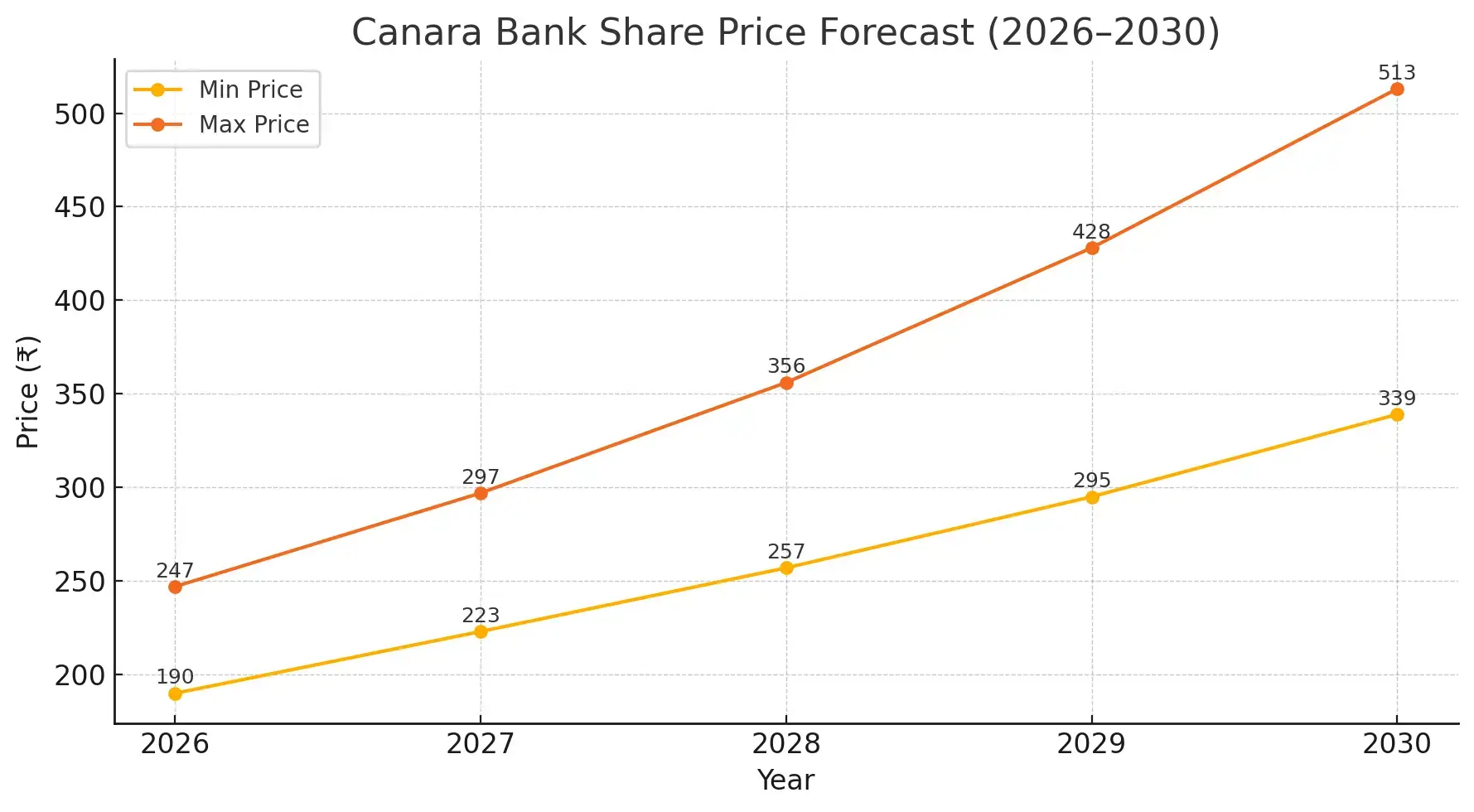

| Year | Min | Max |

|---|---|---|

| 2026 | ₹190 | ₹247 |

| 2027 | ₹223 | ₹297 |

| 2028 | ₹257 | ₹356 |

| 2029 | ₹295 | ₹428 |

| 2030 | ₹339 | ₹513 |

2. Canara Bank Stock Forecast Summary

Canara Bank maintains a strong and stable long-term outlook supported by improving asset quality, consistent profit growth, rising retail and MSME lending, and a solid capital position backed by the Government of India. Its expanding digital footprint, healthy deposit base, and improving operating efficiency further strengthen its growth trajectory for the coming years.

Min Range (2026–2030): ₹190 – ₹339

Max Range (2026–2030): ₹247 – ₹513

3. Investment Calculator

₹0.00 Present Value: ₹0.00 Total Interest: ₹0.00 Future Value: ₹0.00Investment Calculator

4. Strategic Risks & SWOT – Canara Bank

Strengths

- One of India’s Top 10 Largest Banks, giving it strong brand trust and national presence.

- Massive customer base of 11+ crore, ensuring stable deposits and cross-sell opportunities.

- Improving asset quality with declining NPAs, boosting profitability and investor confidence.

- Wide branch & ATM network (≈9,900 branches, 7,900 ATMs), helping drive low-cost deposits (CASA).

- Government backing (PSU) provides stability, capital support, and high credibility among customers.

Weaknesses

- PSU ownership limits agility, leading to slower decision-making versus private banks.

- Lower valuation multiples (P/E & P/B) compared to private-sector peers.

- Higher employee costs and legacy pension obligations reduce operating efficiency.

- Historically volatile NPAs in corporate lending segments.

- Digital adoption slower than leading private banks like HDFC/ICICI/Kotak.

Opportunities

- Strong credit demand in retail, MSME, housing, and agriculture lending.

- Rapid digital transformation can improve operating efficiency and attract younger customers.

- Cross-selling opportunities through insurance, mutual funds, and gold loans.

- Government-led financial inclusion programs can expand rural and semi-urban market share.

- Potential valuation re-rating if ROE, NPA levels, and profitability continue to improve.

Threats

- Rising interest rate or economic slowdown may increase NPAs and reduce margins.

- Aggressive competition from private banks and fintechs in digital banking and retail loans.

- Regulatory and compliancepressures can affect profitability and growth plans.

- Global and domestic market volatility may impact treasury income.

- Operational risks including cyber threats, fraud, or large-scale system outages.

5. Is Canara Bank Stock a Good Buy?

Bull Case:

• Improving asset quality with declining NPAs

• Strong credit growth in retail, MSME, and agriculture

• Large and stable customer base (11+ crore customers)

• Government backing enhances stability and investor confidence

• Digital transformation and efficiency improvements underway

Bear Case:

• PSU bank status may cap valuation compared to private banks

• Higher employee and operational costs impact profitability

• Slower decision-making and execution versus private-sector peers

• Vulnerable to macroeconomic cycles and credit slippages

• Competitive pressure from private banks and fintechs

6. Why Canara Bank’s Share Price May Lag

Possible reasons for underperformance:

• PSU banks often trade at lower valuations compared to private banks

• Credit slippages or rising NPAs can hurt profitability

• High employee and operational costs reduce efficiency

• Slower digital adoption compared to leading private banks

• Sensitive to economic cycles and interest-rate movements

7. Canara Bank Share Price Target 2026

Rationale

• Improving asset quality with lower Net NPA levels, boosting profitability

• Strong credit growth in retail, MSME, and agriculture lending segments

• Consistent quarterly profit growth supported by healthy NII (Net Interest Income)

• Government backing and robust capital position reducing downside risk

• Valuation still reasonable compared to private-sector peers, offering re-rating potential

Assumptions:

• Expected EPS (FY26): ₹20 – ₹22

• Applied P/E ratio range: 8 – 11 (PSU Bank Valuation Range)

• Based on our model, the Canara Bank share price in 2026 is expected to trade between ₹190 and ₹247

Monthly Price Forecast:

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 190 | 205 |

| February | 195 | 210 |

| March | 198 | 215 |

| April | 200 | 220 |

| May | 205 | 225 |

| June | 208 | 230 |

| July | 212 | 235 |

| August | 215 | 238 |

| September | 218 | 242 |

| October | 220 | 245 |

| November | 222 | 247 |

| December | 225 | 247 |

8. Canara Bank Share Price Target 2027

Rationale

• Continued improvement in profitability and credit quality

• Strong loan book growth driven by retail and MSME expansion

• Increasing CASA deposits supporting stable margins

• Ongoing digital initiatives expected to improve operational efficiency

• Potential re-rating if ROE trends upward and NPAs stay under control

Assumptions:

• Expected EPS (FY27): ₹23 – ₹25

• Applied P/E ratio range: 9 – 11

• Based on our model, the Canara Bank share price in 2027 is expected to trade between ₹223 and ₹297

2027 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2027 | ₹223 | ₹297 |

9. Canara Bank Share Price Target 2028

Rationale

• Strong multi-year growth supported by retail lending and fee income

• Improving ROA and ROE driven by lower credit costs

• Expansion of digital channels leading to better cost-efficiency

• Stable deposit base with rising CASA enhancing margin sustainability

• Potential for further valuation improvement if bank maintains consistent profitability

Assumptions:

• Expected EPS (FY28): ₹26 – ₹28

• Applied P/E ratio range: 9 – 12

• Based on our model, the Canara Bank share price in 2028 is expected to trade between ₹257 and ₹356

2028 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2028 | ₹257 | ₹356 |

10. Canara Bank Share Price Target 2029

Rationale

• Higher profitability driven by steady NII growth and controlled credit costs

• Expansion of digital banking and automation improving operational leverage

• Strong deposit franchise supporting low-cost funding

• Improved capital position enabling larger loan book expansion

• Potential for P/E re-rating if Canara Bank maintains consistent performance vs peers

Assumptions:

• Expected EPS (FY29): ₹29 – ₹31

• Applied P/E ratio range: 9 – 12

• Based on our model, the Canara Bank share price in 2029 is expected to trade between ₹295 and ₹428

2029 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2029 | ₹295 | ₹428 |

11. Canara Bank Share Price Target 2030

Rationale

• Long-term compounding driven by consistent earnings growth

• Stronger balance sheet with healthy capital adequacy and lower NPAs

• Multi-year benefits from digital transformation improving cost-to-income ratio

• Steady expansion in retail and MSME loan book supporting high-quality growth

• Potential for Canara Bank to trade at higher valuation multiples if it sustains strong ROE

Assumptions:

• Expected EPS (FY30): ₹33 – ₹35

• Applied P/E ratio range: 10 – 13

• Based on our model, the Canara Bank share price in 2030 is expected to trade between ₹339 and ₹513

2030 Price Forecast:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | ₹339 | ₹513 |

12. FAQ on Canara Bank

Q1. What is the Canara Bank share price target for 2026?

Based on current financial trends and growth outlook, the 2026 target range for Canara Bank is ₹190 – ₹247.

Q2. Can I buy Canara Bank shares now?

Yes, Canara Bank is suitable for investors seeking stable, long-term returns, provided they are comfortable with PSU banking sector risks.

Q3. Is Canara Bank a multibagger?

Canara Bank is considered a steady compounder rather than a high-risk multibagger, supported by improving fundamentals.

Q4. Is Canara Bank good for long-term investment?

Yes. With improving NPAs, rising profitability, strong branch presence, and strong digital adoption, it is a solid long-term investment.

Q5. Is Canara Bank growing?

Yes. Canara Bank is showing consistent growth in retail credit, MSME loans, deposits, and digital banking performance.

Q6. Is Canara Bank stock a good buy?

Yes, it is a good buy for medium- to long-term investors due to strong fundamentals, government support, and improving financial stability.

13. About Canara Bank

Founded: 1906

Founder: Ammembal Subba Rao Pai

Headquarters: Bengaluru, Karnataka, India

Website:www.canarabank.com

Overview:

Canara Bank is one of India’s largest and oldest public-sector banks, serving more than 11 crore customers across the country. Known for its wide national presence, digital banking initiatives, and strong financial foundation, the bank plays a major role in India’s retail, corporate, MSME, and agriculture lending ecosystem. Over the years, Canara Bank has built a diversified portfolio across deposits, loans, payments, bancassurance, and wealth management.

Key Focus Areas:

- Retail & MSME Lending: Strong focus on expanding home loans, personal loans, gold loans, and MSME financing.

- Digital Banking: Rapid adoption of AI-driven and mobile-first solutions to improve customer experience.

- Financial Inclusion: Active participation in government-led programs like Jan Dhan Yojana and priority sector lending.

- Wealth & Insurance Distribution: Cross-selling mutual funds, insurance, and investment products through its vast branch network.

Mission:

To provide trusted, technology-driven, and customer-centric financial solutions while strengthening India’s economic growth across urban and rural segments.

14. How Canara Bank Earns Revenue

Canara Bank generates revenue from multiple banking and financial service streams that support both retail and corporate customers.

- Interest Income: The biggest revenue source, earned from loans such as home loans, MSME loans, personal loans, gold loans, education loans, and corporate lending.

- Fee & Service Charges: Income from ATM charges, fund transfers, processing fees, credit card/debit card fees, and customer service charges.

- Treasury Operations: Revenue from investing in government securities, bonds, and other financial instruments.

- Bancassurance & Wealth Management: Commission earned by selling insurance, mutual funds, and investment products through its vast branch network.

- Foreign Exchange & Trade Finance: Revenue from forex transactions, remittances, LC (Letter of Credit), and bank guarantees for businesses.

Canara Bank Key Highlights

- 🏦 Large Customer Base: Serves over 11 crore customers across India.

- 🌐 Wide Network: Nearly 9,900 branches and 7,900 ATMs.

- 📊 Strong Loan Book: Retail, MSME, agriculture, and corporate lending.

- 💰 Stable Revenue Model: Driven by interest income, fees, and treasury operations.

- 📈 Growth Focus: Digital banking expansion, NPA reduction, and improving profitability.

15. Conclusion & Future Outlook

Canara Bank continues to strengthen its position as one of India’s leading PSU banks. With improving asset quality, consistent profit growth, and a strong push in retail & MSME lending, the bank is well-positioned for stable long-term performance.

Ongoing digital transformation, rising customer adoption, and better cost efficiency further support future growth. As NPAs decline and operational metrics improve, investor confidence and valuation re-rating could follow.

Overall, Canara Bank offers a steady long-term opportunity for investors seeking consistent growth backed by strong fundamentals and government support.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial advice. The content is based on publicly available data, and while we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information. Always consult with a qualified financial advisor or professional before making any investment or financial decisions.

Leave a comment

Your email address will not be published. Required fields are marked *