Shakti Pumps (India) Ltd(NSE: SHAKTIPUMP) share price is in focus as the company benefits from solar pump demand, PM-KUSUM scheme orders, strong ROCE, and capacity expansion plans. This article covers Shakti Pumps share price target 2026, 2027, 2028, 2029 and 2030, key fundamentals, valuation, and whether the stock suits traders and long-term investors.

Table of Contents

- Shakti Pumps – Company Overview

- Shakti Pumps Share Price Target 2026

- Shakti Pumps Share Price Target 2027

- Shakti Pumps Share Price Target 2028

- Shakti Pumps Share Price Target 2029

- Shakti Pumps Share Price Target 2030

- Should You Buy Shakti Pumps Stock?

- Key Financial & Valuation Metrics

- Peer Comparison

- Final Verdict

- FAQs

1. Shakti Pumps (India) Ltd – Company Overview

Shakti Pumps (India) Ltd is a leading Indian manufacturer of solar pumps, submersible pumps, motors, and controllers, serving agriculture, industrial, solar, and export markets across 100+ countries.

The company is the largest beneficiary of the PM-KUSUM solar pump scheme with ~25% market share and has installed over 1.14 lakh solar pumps.

Shakti Pumps Share Price Target 2026

- Strong order book supports earnings visibility into FY26.

- Solar pump demand under PM-KUSUM remains steady.

- Margins likely to normalize after sharp FY24–25 expansion.

- Stock may consolidate after recent correction.

Shakti Pumps Share Price Target 2026: ₹820 – ₹980

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2026 | 820 | 900 | 980 |

Shakti Pumps Share Price Target 2027

- Capacity expansion starts contributing meaningfully.

- Export and industrial pump mix improves.

- EV motor business remains optional upside.

Shakti Pumps Share Price Target 2027: ₹950 – ₹1,150

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2027 | 950 | 1,050 | 1,150 |

Shakti Pumps Share Price Target 2028

- New manufacturing capacity reaches higher utilisation.

- Operating leverage supports steady EPS growth.

- Government policy continuity remains key.

Shakti Pumps Share Price Target 2028: ₹1,100 – ₹1,350

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2028 | 1,100 | 1,225 | 1,350 |

Shakti Pumps Share Price Target 2029

- Peak benefits of capex cycle expected.

- Exports add earnings stability.

- Valuation driven by cash-flow discipline.

Shakti Pumps Share Price Target 2029: ₹1,300 – ₹1,650

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2029 | 1,300 | 1,475 | 1,650 |

Shakti Pumps Share Price Target 2030

- Company may emerge as a global solar pump leader.

- EV and industrial segments provide optional upside.

- Returns depend on long-term government policy support.

Shakti Pumps Share Price Target 2030: ₹1,500 – ₹1,950

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2030 | 1,500 | 1,725 | 1,950 |

6. Should You Buy Shakti Pumps Stock?

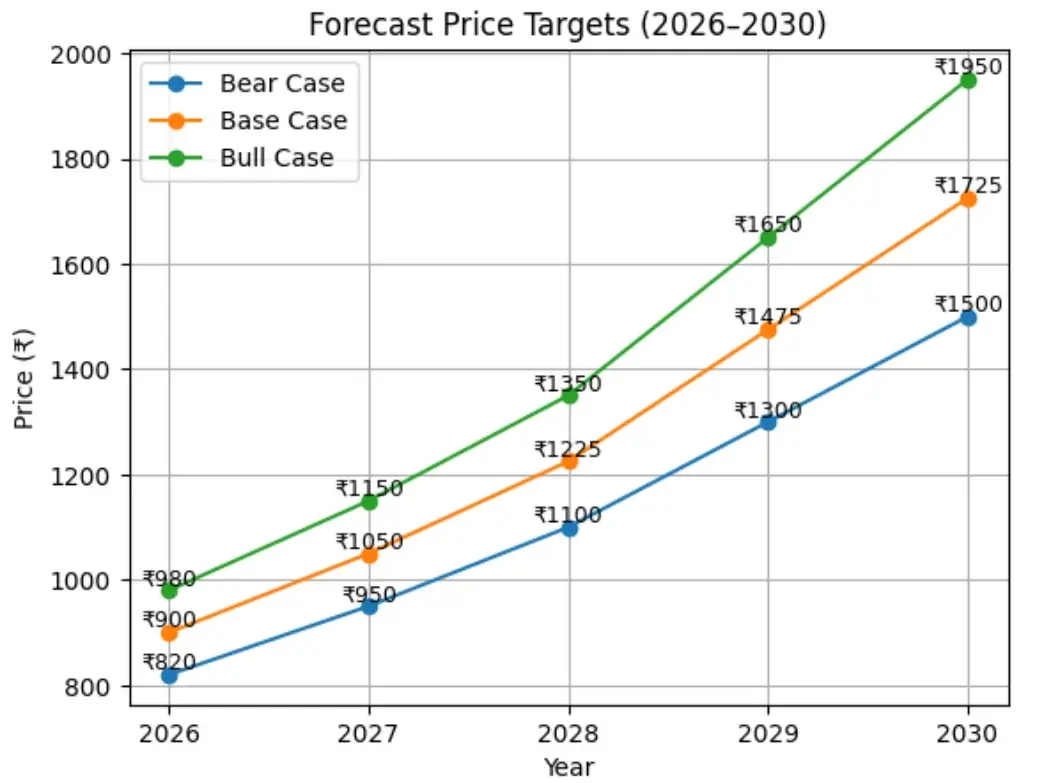

| Year | Bear Case (₹) | Base Case (₹) | Bull Case (₹) |

|---|---|---|---|

| 2026 | 820 | 900 | 980 |

| 2027 | 950 | 1,050 | 1,150 |

| 2028 | 1,100 | 1,225 | 1,350 |

| 2029 | 1,300 | 1,475 | 1,650 |

| 2030 | 1,500 | 1,725 | 1,950 |

Valuation Snapshot

- Targets based on EPS growth, sector P/E, order book visibility.

- Bear case assumes policy delays & working-capital pressure.

- Bull case assumes capacity expansion + export growth.

Investor Verdict

- Short-term traders: High volatility, reacts to govt order news.

- Long-term investors: Strong ROCE, solar tailwinds, but policy risk.

- Best suited for investors with 3–5 year horizon.

8. Shakti Pumps (India) Ltd – Annual Earnings

Key financials of Shakti Pumps (India) Ltd (NSE: SHAKTIPUMP) over the last several fiscal years, highlighting revenue growth, profitability, and operating efficiency for traders and long-term investors.

Source: Company annual reports, NSE/BSE disclosures & investor presentations.

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 | TTM |

|---|---|---|---|---|---|---|

| Revenue (₹ Crore) | 930 | 1,179 | 968 | 1,371 | 2,516 | 2,603 |

| Operating Profit (₹ Crore) | 142 | 110 | 67 | 225 | 603 | 598 |

| OPM % | 15% | 9% | 7% | 16% | 24% | 23% |

| Net Profit / PAT (₹ Crore) | 76 | 65 | 24 | 142 | 408 | 402 |

| EPS (₹) | 6.85 | 5.88 | 2.19 | 11.79 | 33.97 | 33.24 |

- Revenue Growth: Driven by PM-KUSUM solar pump orders and rising government projects.

- Margin Expansion: OPM improved sharply to ~23% due to scale benefits and operating leverage.

- Profit Growth: PAT CAGR of ~99% over 5 years reflects strong earnings momentum.

- Capital Efficiency: ROCE of ~55% highlights efficient capital utilization.

- Order Book: Robust ₹1,800 Cr order book provides near-term revenue visibility.

Financial Snapshot: Shakti Pumps has transitioned into a high-growth, high-ROCE business supported by solar adoption, government schemes, and capacity expansion, though working capital intensity remains a key risk.

9. Shakti Pumps (India) Ltd – Key Valuation Metrics

Important valuation and profitability ratios for Shakti Pumps (India) Ltd, helping traders and investors assess pricing, growth sustainability, and risk.

| Metric | Value |

|---|---|

| TTM P/E Ratio | 23.8 |

| P/B Ratio | 5.8 |

| ROA | 19.6% |

| ROE | 42.6% |

| ROCE | 55.3% |

| Debt-to-Equity Ratio | 0.38 |

| Market Cap | ₹9,539 Cr |

| EPS (TTM) | ₹33.2 / share |

10. Shakti Pumps (India) Ltd – Key Peers & Comparison

Peer comparison of Shakti Pumps with leading pump and industrial equipment manufacturers based on valuation, profitability, and return ratios.

| Company | P/E | Market Cap (₹ Cr) | Qtr Profit (₹ Cr) | Qtr Revenue (₹ Cr) | ROCE % |

|---|---|---|---|---|---|

| Cummins India | 53.9 | 1,24,377 | 622 | 3,170 | 36.3% |

| Kirloskar Oil Engines | 35.7 | 17,377 | 159 | 1,948 | 13.7% |

| KSB | 49.1 | 12,889 | 68 | 650 | 23.8% |

| Kirloskar Brothers | 33.4 | 13,241 | 72 | 1,028 | 27.6% |

| Shakti Pumps | 23.8 | 9,539 | 91 | 666 | 55.3% |

11. Is Shakti Pumps a Good Buy for Long Term?

Bull Case

- Leader in solar pumps with strong PM-KUSUM exposure.

- High ROCE and improving margins.

- Capacity expansion supports medium-term growth.

Bear Case

- High dependence on government policies.

- Working-capital intensity affects cash flows.

- Promoter holding has declined in recent years.

Verdict

Shakti Pumps is suitable for long-term investors seeking exposure to India’s solar and agriculture capex theme. Traders should expect volatility.

12. Final Verdict – Shakti Pumps (India) Ltd

Shakti Pumps is a fundamentally strong company benefiting from solar adoption, government schemes, and capacity expansion.

High ROCE and earnings growth support long-term prospects, but investors must monitor policy risk and cash-flow discipline.

Best for: Long-term investors (3–5 years) and experienced traders.

13. FAQ on Shakti Pumps (India) Ltd

Q1. What is the target price of Shakti Pumps in 2026?

Based on current fundamentals, order book, and earnings visibility, the Shakti Pumps share price target for 2026 is estimated at ₹820 – ₹980 under realistic market conditions.

Q2. Is Shakti Pumps a good buy?

Yes, selectively. Shakti Pumps is well-positioned in the solar pump and agriculture infrastructure segment. Key positives:

- Strong beneficiary of the PM-KUSUM solar pump scheme

- High ROCE (~55%) and ROE (~42%)

- Healthy order book of ~₹1,800 Cr

Q3. Why are Shakti Pumps share prices rising?

Shakti Pumps shares rise mainly due to:

- Large government solar pump orders and execution updates

- Sharp improvement in margins and profitability

- Positive sentiment around renewable energy and agri-infra stocks

Q4. Shakti Pumps share price target 2030

The Shakti Pumps share price target for 2030 in India is estimated at ₹1,500 – ₹1,950, assuming continued policy support, capacity expansion, and stable cash flows.

Q5. Shakti Pumps share price target 2027

For 2027, Shakti Pumps may trade in the range of ₹950 – ₹1,150, depending on execution of government orders and export growth.

Q6. Why is Shakti Pumps share falling?

Short-term declines in Shakti Pumps shares are usually due to:

- Profit booking after sharp rallies

- Delays in government project payments

- Concerns around high working-capital requirements

Q7. Is Shakti Pumps debt free?

No. Shakti Pumps is not debt-free, but its balance sheet remains manageable with a debt-to-equity ratio of ~0.38, supported by strong operating cash generation.

Q8. Is Shakti Pumps share good to buy for long term?

Yes, with a long-term view. Shakti Pumps is suitable for investors with a 3–5 year horizon who can tolerate policy-linked volatility.

Q9. Is Shakti Pumps a good long-term investment?

Long-term investment merits include:

- Leadership in solar water pumping solutions

- High capital efficiency and improving margins

- Growing export footprint across 100+ countries

Q10. What are the key risks in Shakti Pumps stock?

Investors should monitor:

- Dependence on government policies and subsidies

- Working-capital stress and delayed receivables

- Decline in promoter holding over recent years

Disclaimer

This article is for general informational and educational purposes only and should not be considered financial or investment advice. Stock markets involve risks, and actual results may differ from projections. Always conduct your own research or consult a licensed financial professional before making investment decisions. ChartMyWealth.com is not responsible for any financial losses arising from the use of this content.

Leave a comment

Your email address will not be published. Required fields are marked *