AstraZeneca’s transformation from a 1999 Anglo-Swedish merger into a global biotech leader highlights decisive R&D focus, bold acquisitions, and a clear pivot to oncology and biologics. This feature covers AstraZeneca’s founding, vaccine leadership, oncology success, financial performance, and the company’s roadmap toward AI-driven drug discovery and sustainability.

Table of Contents

- Introduction: AstraZeneca’s Rise in Global Biopharma

- The Merger: Astra + Zeneca (1999)

- The Early 2000s: Consolidation & Research Expansion

- The Oncology Pivot: 2013–2020

- COVID-19 & Global Vaccine Leadership (2020–2022)

- Beyond Vaccines: Biologics, AI, and Rare Diseases (2022–2025)

- AstraZeneca by the Numbers (Tables & Charts)

- Stock Performance & Market Value

- Strategic Acquisitions & Partnerships

- The Future: AI-Driven Drug Discovery & Sustainability

- Final Thoughts

- FAQ

1. Introduction: AstraZeneca’s Rise in Global Biopharma

Founded in 1999 through the merger of Sweden’s Astra AB and Britain’s Zeneca Group, AstraZeneca PLC (AZN) has evolved into one of the world’s most innovative and scientifically driven pharmaceutical giants.

With a focus spanning oncology, cardiovascular, respiratory, and rare diseases, AstraZeneca’s patient-first philosophy and robust R&D pipeline have made it a leader in modern biopharma. As of 2025, AstraZeneca operates in over 100 countries, employs more than 105,000 people, and boasts a market capitalization above $220 billion.

2. The Merger: Astra + Zeneca (1999)

Formation:

- Year: 1999

- Combined Value: $67 billion

- Headquarters: Cambridge, UK

| Year | Milestone | Notes |

|---|---|---|

| 1999 | Astra + Zeneca merger | Created the 3rd-largest pharma company by revenue |

| 2000 | Integration of R&D units | Focus on oncology, cardiovascular, and GI research |

| 2002 | First global blockbuster – Nexium | $5B+ annual peak sales |

Revenue (1999–2002): $15.8B → $22.5B → +42% growth

3. The Early 2000s: Consolidation & Research Expansion

During 2000–2010, AstraZeneca solidified its reputation as a science-led company.

Key Highlights:

- Development of Crestor (statin), Symbicort (asthma), and Seroquel (antipsychotic).

- 2007: Opened a $100M R&D hub in the UK.

- 2009: Entered biologics via acquisition of MedImmune ($15.6B).

R&D Spend (2005–2010): $3.8B → $5.3B annually (~18% of revenue)

4. The Oncology Pivot: 2013–2020

Under CEO Pascal Soriot (appointed 2012), AstraZeneca underwent a strategic transformation, repositioning itself around oncology, rare diseases, and biologics.

Key Milestones:

- 2014: Hostile takeover offer by Pfizer ($118B) — rejected.

- 2015: Refocus on R&D and immuno-oncology.

- 2018: Lynparza, Imfinzi, and Tagrisso become blockbuster drugs.

- 2020: 40% of revenue from oncology.

| Year | Oncology Revenue ($B) | % of Total | Flagship Drugs |

|---|---|---|---|

| 2015 | 3.4 | 15% | Tagrisso, Lynparza |

| 2020 | 11.5 | 37% | Imfinzi, Calquence |

| 2024 | 18.8 | 40% | 9 oncology brands in >$1B sales club |

5. COVID-19 & Global Vaccine Leadership (2020–2022)

During the pandemic, AstraZeneca developed one of the world’s most distributed COVID-19 vaccines in partnership with the University of Oxford.

- 2020–2022: 3.5+ billion doses delivered to 180+ countries.

- Supplied at non-profit pricing during pandemic phase.

- Recognized for equitable access and global distribution.

Impact: Boosted reputation, R&D credibility, and emerging-market presence.

External reading: WHO vaccine articles, Reuters coverage.

6. Beyond Vaccines: Biologics, AI, and Rare Diseases (2022–2025)

AstraZeneca is now a biotech-driven pharmaceutical company leveraging AI, genomics, and precision medicine.

| Year | Total Revenue ($B) | R&D Spend ($B) | Employees | Oncology % |

|---|---|---|---|---|

| 2020 | 26.6 | 6.0 | 76K | 37% |

| 2022 | 44.4 | 7.2 | 94K | 39% |

| 2024 | 47.1 | 8.0 | 105K | 40% |

| 2025 (est.) | 49.5 | 8.6 | 108K | 41% |

Core Growth Drivers (2022–2025): Alexion acquisition (rare diseases), AI partnerships (BenevolentAI & NVIDIA), expansion in cell & gene therapy, and a strong sustainability push aiming carbon neutral operations by 2025.

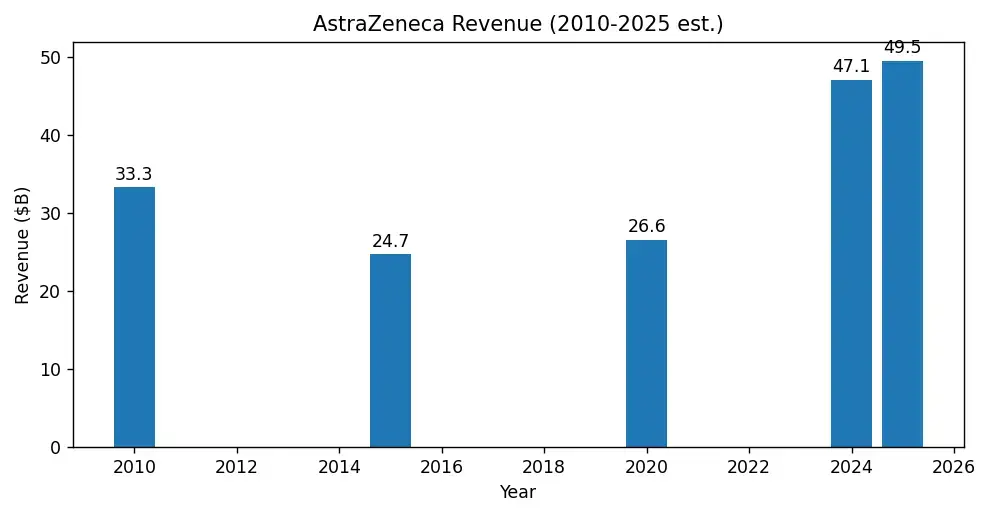

7. AstraZeneca by the Numbers

| Metric | 2010 | 2015 | 2020 | 2025 (est.) |

|---|---|---|---|---|

| Revenue ($B) | 33.3 | 24.7 | 26.6 | 49.5 |

| Net Income ($B) | 7.3 | 2.6 | 3.2 | 8.5 |

| R&D Spend ($B) | 4.0 | 5.3 | 6.0 | 8.6 |

| Employees | 62K | 61K | 76K | 108K |

| Market Cap ($B) | 60 | 80 | 140 | 220 |

8. Stock Performance & Market Value

| Year | Share Price (GBP) | Market Cap ($B) | Dividend Yield |

|---|---|---|---|

| 2000 | £12.40 | 80 | 2.5% |

| 2010 | £28.50 | 60 | 4.0% |

| 2020 | £75.20 | 140 | 2.8% |

| 2025 | £120.00 | 220 | 2.1% |

10-Year Return (2015–2025): +350% (approx.).

9. Strategic Acquisitions & Partnerships

| Year | Company | Value ($B) | Focus |

|---|---|---|---|

| 2007 | MedImmune | 15.6 | Biologics |

| 2021 | Alexion | 39.0 | Rare diseases & immunology |

| 2023 | Gracell Biotechnologies | 1.2 | Cell therapy |

| 2024 | Amolyt Pharma | 1.05 | Endocrine disorders |

| 2025 | BenevolentAI (stake) | — | AI-driven drug discovery |

Partnership highlights: collaborations with NVIDIA for AI acceleration, university partnerships for translational science, and manufacturing scale-ups to support global supply.

10. The Future: AI-Driven Drug Discovery & Sustainability

- AI Integration: Digital twin technology for molecule modeling and accelerated lead discovery.

- Precision Medicine: Genetic targeting across oncology & CVRM.

- Manufacturing 4.0: Smart, carbon-neutral production lines by 2025.

- Sustainability: Net-zero emissions by 2030 across the full supply chain.

External reading: AstraZeneca Investor Relations, Nature.

11. Final Thoughts

From a merger in 1999 to a world-class biopharma innovator, AstraZeneca’s journey reflects resilience, science-first strategy, and a commitment to improving global health. With leadership in oncology, biologics, and AI-driven research, AstraZeneca blends purpose with performance.

12. FAQ

Q1. When was AstraZeneca founded?

A1. AstraZeneca was formed on April 6, 1999 through the merger of Astra AB and Zeneca Group.

Q2. What are AstraZeneca’s top drugs?

A2. Tagrisso, Imfinzi, Lynparza, Calquence, and Farxiga are among AstraZeneca’s top-selling medicines.

Q3. How large is AstraZeneca today?

A3. As of 2025, AstraZeneca’s market cap is around $220 billion with over 100,000 employees.

Q4. What drives AstraZeneca’s future growth?

A4. Oncology leadership, rare disease therapeutics, AI-driven drug discovery, and sustainability.

Q5. Where is AstraZeneca headquartered?

A5. In Cambridge, United Kingdom.

Sources & Further Reading

- AstraZeneca — Official Website & Investor Relations

- Reuters — AstraZeneca coverage

- Nature — Research & commentary

- World Health Organization — Vaccine distribution

Figures are compiled from company filings and analyst estimates (2025). For live stock data and filings check AstraZeneca IR or your preferred market-data provider.

Disclaimer: This article is for informational purposes only and is not investment or medical advice. Always perform your own due diligence and consult professionals where appropriate.

Leave a comment

Your email address will not be published. Required fields are marked *