BP p.l.c. has evolved from a century-old oil major into a diversified energy leader balancing traditional hydrocarbons with renewables, EV charging and hydrogen. This deep-dive provides revenue trends, dividend insight, competitive comparisons, and a practical investor takeaway to help UK and global investors evaluate BP in 2025.

Table of Contents

- Introduction: BP’s Legacy in British Energy

- The Evolution of BP p.l.c.

- BP’s Global Footprint

- Financial Overview & Revenue Growth

- Dividend Policy & Investor Appeal

- Sustainability & Energy Transition

- BP vs Competitors (Shell, TotalEnergies)

- Stock Performance & UK Market Impact

- Strategic Resets & Future Outlook

- BP by the Numbers (Tables & Charts)

- Investor Takeaways

- FAQ

1. Introduction: BP’s Legacy in British Energy

Founded in 1909 as the Anglo-Persian Oil Company, BP p.l.c. has been a cornerstone of the UK economy for more than a century. Headquartered in London, BP operates across the energy value chain — from exploration and production to renewables, retail, and electric mobility.

BP’s inclusion in the FTSE 100 and its long dividend history make it one of the most searched and traded UK stocks among institutional and retail investors alike.

2. The Evolution of BP p.l.c.

BP’s corporate journey reflects a century of innovation and reinvention — from oil exploration to digital transformation and low-carbon energy initiatives.

| Period | Milestone | Strategic Focus |

|---|---|---|

| 1909–1950s | Founded as Anglo-Persian Oil Company | Middle East exploration |

| 1970s–1990s | Merger with Amoco & acquisitions | Global oil dominance |

| 2000–2015 | Deepwater Horizon impact & restructuring | Safety, cost control |

| 2016–2024 | Net-zero & renewables push | Low-carbon strategy |

| 2025+ | “Reset” under CEO Murray Auchincloss | Balanced energy portfolio |

3. BP’s Global Footprint

- Operates in 60+ countries worldwide

- Over 18,000 service stations

- 3,500+ ultra-fast EV chargers across the UK

- Over 70,000 employees globally

BP continues to expand in emerging markets while maintaining strong UK operations and partnerships with the government for sustainable transport initiatives.

External reading: BP — Who we are (BP official).

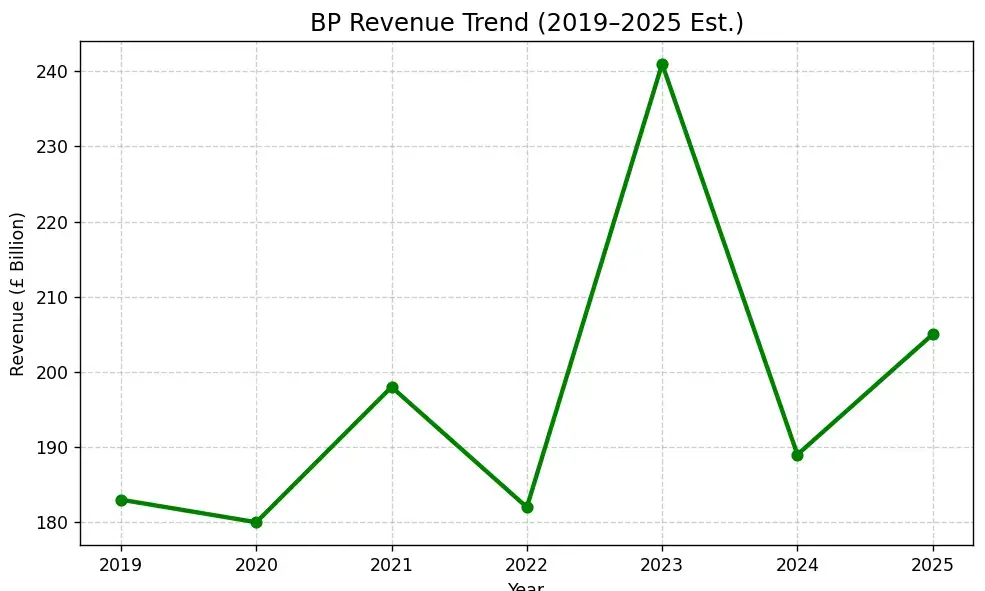

4. Financial Overview & Revenue Growth

BP’s revenues rebounded post-pandemic, driven by oil price recovery and trading performance. The company remains one of the largest contributors to UK tax receipts.

| Year | Revenue (£ billion) | Net Income (£ billion) | Operating Cash Flow (£ billion) |

|---|---|---|---|

| 2019 | 183 | 10.0 | 26.0 |

| 2020 | 180 | −4.0 | 19.0 |

| 2022 | 182 | 22.0 | 30.5 |

| 2023 | 241 | 25.7 | 31.0 |

| 2024 | 189 | 17.8 | 28.2 |

| 2025 (est.) | 205 | 19.0 | 29.4 |

BP’s revenue trend shows strong resilience amid global energy volatility.

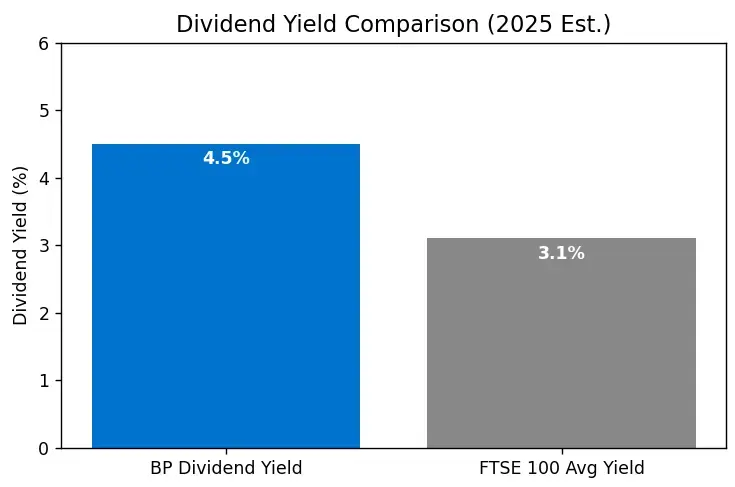

5. Dividend Policy & Investor Appeal

BP is known for its consistent dividend payments, appealing to UK income investors. The current dividend yield stands near 4.5 %, higher than the FTSE 100 average (≈ 3.1 %).

10-Year Return (2015–2025 est.): +150 %

6. Sustainability & Energy Transition

BP’s “Reinvent” and “Net Zero 2050” strategies mark its shift toward sustainable energy, EV charging infrastructure, and hydrogen projects.

- Investing £1.5 billion annually in renewables

- Targeting 50 GW of renewable capacity by 2030

- UK’s largest EV charging provider via BP Pulse

Read more: International Energy Agency (IEA) and BP Sustainability.

7. BP vs Competitors (Shell & TotalEnergies)

| Company | 2024 Revenue (£ billion) | Dividend Yield | Low-Carbon Investment Share |

|---|---|---|---|

| BP p.l.c. | 189 | 4.5 % | 12 % |

| Shell plc | 259 | 3.9 % | 11 % |

| TotalEnergies SE | 193 | 5.0 % | 14 % |

BP’s financial strength and UK focus position it as a long-term dividend and value play within the FTSE 100.

External coverage: Reuters — BP coverage, Financial Times — Energy sector.

8. Stock Performance & UK Market Impact

- BP LON:BP trades near £5.40 (2025 Q4 est.)

- Market Capitalisation ≈ £90 billion

- 52-week range: £4.70 – £5.70

- Beta ≈ 1.2 (FTSE 100 correlation)

BP remains a top-five constituent by market cap on the London Stock Exchange, influencing the broader UK energy sector sentiment.

9. Strategic Resets & Future Outlook

CEO Murray Auchincloss’s 2025 plan focuses on streamlining costs, enhancing trading, and selectively investing in renewables. BP aims to reduce $2 billion in expenses by 2026 while maintaining shareholder returns.

Upcoming catalysts include hydrogen hub expansion in Teesside, offshore wind in Scotland, and EV charging growth across Europe.

10. BP by the Numbers

11. Investor Takeaways

- BP remains one of the most searched UK stocks on Google and investor platforms.

- High dividend yield + solid cash flow = strong long-term appeal.

- Balanced strategy between oil profitability and green energy growth.

- Attractive for UK income and ESG-minded investors alike.

12. FAQ

Q1. Is BP still a good investment in 2025?

Yes — BP offers stable dividends and a gradual green transition plan, making it a core FTSE 100 holding for many UK investors.

Q2. What is BP’s dividend yield?

Approximately 4.5 % as of 2025, paid quarterly.

Q3. Where is BP headquartered?

BP’s global headquarters are in London, United Kingdom (St James’s Square).

Q4. Is BP investing in renewable energy?

Yes — BP is actively investing in offshore wind, hydrogen projects and EV charging infrastructure through BP Pulse.

Sources & Further Reading

Disclaimer: This article is for informational purposes and is not investment or tax advice. Always carry out your own research or consult a qualified adviser before making investments.