General Motors (GM) remains a strong player in the global automotive industry, supported by its ICE dominance, growing EV portfolio, and expanding technological capabilities. This article provides a complete, structured forecast covering GM’s expected stock performance from 2026 to 2030.

Table of Contents

- Key Summary & Overview

- GM Stock Price Forecast: 2026–2030

- Interactive Investment Calculator

- SWOT Analysis & Risk Factors

- GM Share Price Target for 2026

- GM Share Price Target for 2027

- GM Share Price Target for 2028

- GM Share Price Target for 2029

- GM Share Price Target for 2030

- GM Stock Price Forecast & Investment FAQ

- About General Motors (GM)

- GM's Revenue Streams & Business Model

- Conclusion & Future Outlook

GM Stock Price Target (2026–2030)

Key Growth Factors:

- EV Transition: Expansion of electric vehicle lineup (e.g., Chevrolet Bolt EV, Cadillac Lyriq).

- Autonomous Driving: Investment in Cruise and self-driving technology.

- Global Growth: Expansion in key markets like China and India.

- Sustainability: Commitment to zero emissions by 2035.

- Connected Services: Growth in subscription-based services (e.g., OnStar).

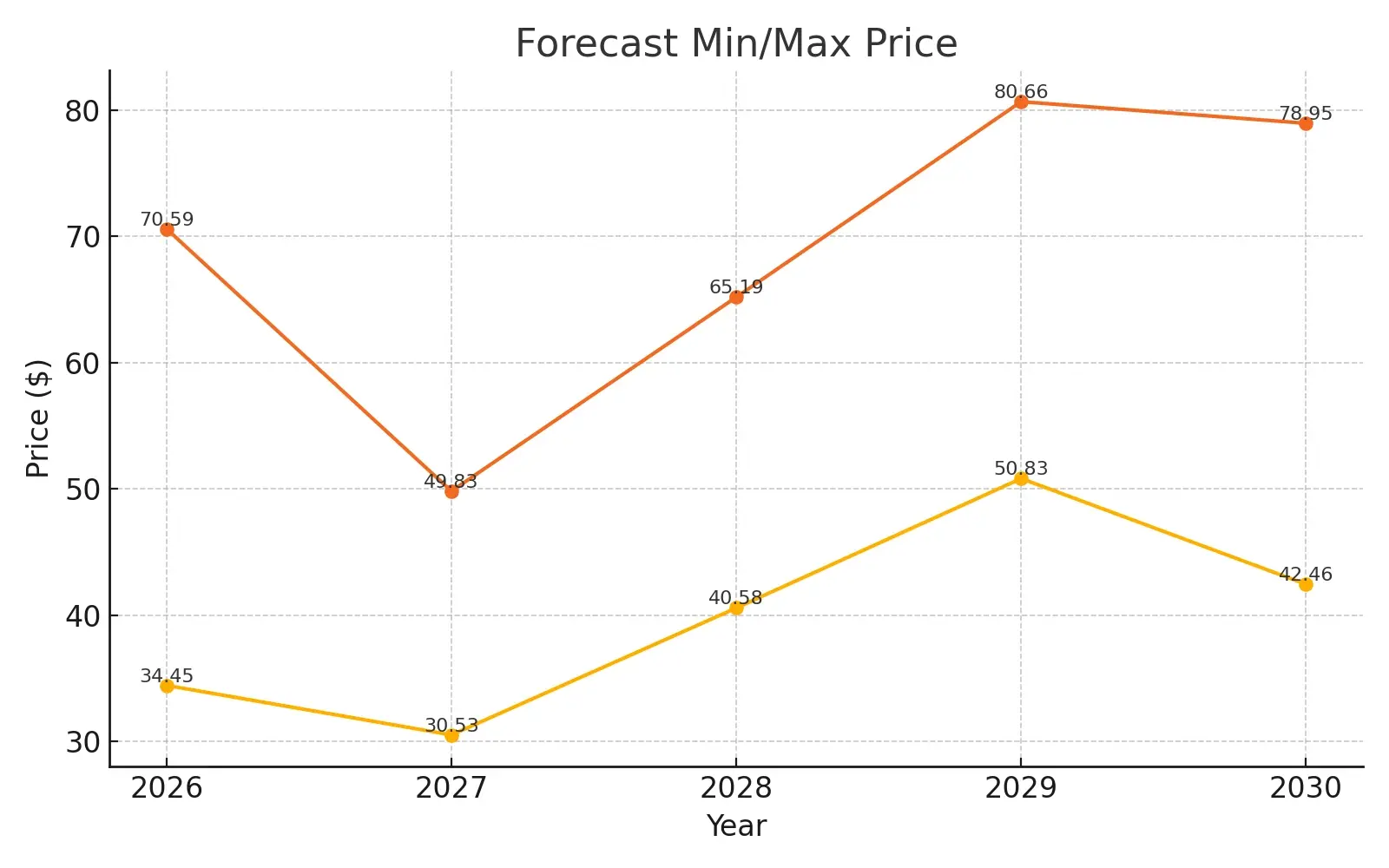

By prediction for 2030, the share price target is between $42.46 and $78.95.

| Year | Min ($) | Max ($) |

|---|---|---|

| 2026 | $34.45 | $70.59 |

| 2027 | $30.53 | $49.83 |

| 2028 | $40.58 | $65.19 |

| 2029 | $50.83 | $80.66 |

| 2030 | $42.46 | $78.95 |

GM Stock Forecast Summary

GM shows a stable long-term outlook powered by EV push, North American dominance, and strong manufacturing capabilities.

Min Range (2026–2030): $30.53 – $50.80

Max Range (2026–2030): $49.83 – $80.66

Investment Calculator

₹0.00 Present Value: ₹0.00 Total Interest: ₹0.00 Future Value: ₹0.00Investment Calculator

Strategic Risks & SWOT

Strengths

- Strong US market footprint

- Ultium battery platform scalability

- Profitable ICE truck/SUV segments

Weaknesses

- Tariff vulnerability

- High legacy pension/health costs

- EV scaling delays

Opportunities

- Rapid EV adoption

- US manufacturing shift

- Software-driven recurring revenue

Threats

- Tariff headwinds

- EV competition (Tesla, BYD)

- High interest rates slowing auto demand

GM Share Price Target for 2026

Key Growth Factors for 2026:

- Focus on electric vehicles (EVs), including new models like the Chevrolet Bolt EV and Cadillac Lyriq.

- Increased global demand for EVs and sustainability initiatives.

- Growth driven by GM's expanding electric vehicle lineup.

By prediction for 2026, the share price target is between $34.45 and $70.59.

| Month | Min | Max |

|---|---|---|

| January | $ 57.06 | $ 70.59 |

| February | $ 51.45 | $ 62.49 |

| March | $ 46.69 | $ 51.86 |

| April | $ 43.06 | $ 49.25 |

| May | $ 40.20 | $ 45.84 |

| June | $ 36.01 | $ 44.10 |

| July | $ 4.45 | $ 41.78 |

| August | $ 40.95 | $ 45.70 |

| September | $ 37.26 | $ 47.32 |

| October | $ 36.41 | $ 44.55 |

| November | $ 43.75 | $ 46.22 |

| December | $ 37.64 | $ 46.17 |

GM Share Price Target for 2027

Key Growth Factors for 2027:

- Leadership in EV market with 30+ new EVs planned by 2025.

- Growth in autonomous driving through Cruise.

- Strong global market expansion, particularly in China and India.

By prediction for 2027, the share price target is between $30.53 and $49.83.

| Year | Min Price ($) | Max Price ($) |

|---|---|---|

| 2027 | $30.53 | $49.83 |

GM Share Price Target for 2028

Key Growth Factors for 2028:

- Significant growth in EV sales and battery technology.

- Expansion of connected services and software offerings.

- Strong adoption of autonomous vehicles.

By prediction for 2028, the share price target is between $40.58 and $65.19.

| Year | Min Price ($) | Max Price ($) |

|---|---|---|

| 2028 | $40.58 | $65.19 |

GM Share Price Target for 2029

Key Growth Factors for 2029:

- Continued EV adoption and autonomous vehicle rollout.

- Market growth in emerging economies.

- Expansion of in-car subscription services like OnStar.

By prediction for 2029, the share price target is between $50.83 and $80.66.

| Year | Min Price ($) | Max Price ($) |

|---|---|---|

| 2029 | $50.83 | $80.66 |

GM Share Price Target for 2030

Key Growth Factors for 2030:

- Transition to a fully electric future by 2035.

- Cruise autonomous vehicles driving new revenue streams.

- Strong global sales from EV and autonomous markets.

By prediction for 2030, the share price target is between $42.46 and $78.95.

| Year | Min Price ($) | Max Price ($) |

|---|---|---|

| 2030 | $42.46 | $78.95 |

About GM

Founded: 1908

Founder: William C. Durant

Headquarters: Detroit, Michigan, USA

Website:www.gm.com

Overview:

General Motors (GM) is one of the world's largest automotive manufacturers, known for iconic brands such as Chevrolet, Cadillac, GMC, and Buick. Founded in 1908, GM has a long legacy of innovation, from the introduction of the assembly line to the development of electric vehicles (EVs).

Key Focus:

- Electric Vehicles (EVs): GM is transitioning to an all-electric future with a goal of offering 30 new EVs by 2025 and achieving zero emissions by 2035.

- Autonomous Driving: GM is investing in autonomous technology through its subsidiary Cruise.

- Global Presence: GM operates in over 100 countries and continues to expand its footprint in key markets like China and Europe.

Mission: GM is committed to creating a world with zero crashes, zero emissions, and zero congestion.

How GM Makes Money

General Motors (GM) generates revenue from several key business segments:

- Vehicle Sales: GM sells cars, trucks, SUVs, and electric vehicles (EVs) under brands like Chevrolet, GMC, Cadillac, and Buick. Key models include the Chevrolet Silverado and GMC Sierra.

- GM Financial: Provides loans and leases for customers and dealers, plus insurance products.

- Electric Vehicles (EVs): GM is focusing on EV growth, with models like the Chevrolet Bolt EV and GMC Hummer EV. GM plans to launch 30 new EVs by 2025.

- Connected Services: GM offers services like OnStar, In-Vehicle Wi-Fi, and is investing in autonomous driving via its subsidiary, Cruise.

- Global Operations: GM operates in over 100 countries, with a strong presence in North America, China, and Europe.

GM Key Highlights (2024)

- 🚗 Total Vehicles Sold (2024): Over 6.8 million globally.

- 🔑 Key Models: Chevrolet Silverado, GMC Sierra, Chevrolet Bolt EV.

- ⚡ EV Target: GM aims to sell 200,000+ electric vehicles by 2025.

Conclusion

General Motors (GM) is evolving by diversifying its revenue streams, focusing on vehicle sales, financing, and cutting-edge technologies like electric vehicles (EVs) and connected services. With a strong emphasis on sustainability, GM is positioning itself as a leader in the global automotive industry.

GM’s ongoing investments in EVs and autonomous driving, along with its expanding global presence, set the stage for continued growth and solidify its role in shaping the future of transportation.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial advice. The content is based on publicly available data, and while we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information. Always consult with a qualified financial advisor or professional before making any investment or financial decisions.

Leave a comment

Your email address will not be published. Required fields are marked *