Piccadily Agro Industries Ltd has rapidly emerged as a strong contender in India’s alcoholic beverage and agro-processing sectors, powered by its premium whisky brand Indriand aggressive capacity expansions. With growing investor interest, the key questions now are: Is Piccadily Agro a good buy?What could its share price look like in 2026, 2027, 2028, 2029, and 2030? And how solid is its long-term growth potential?

In this article, we analyze the company’s business fundamentals, financial performance, risks, and expansion plans—along with clear, data-driven share price targets for 2026 to 2030 to help you evaluate whether Piccadily Agro is positioned for meaningful long-term returns.

Table of Contents

- Should You Buy Piccadily Agro?

- Piccadily Agro Stock Price Forecast: 2026–2030

- Interactive Investment Calculator

- SWOT Analysis & Risk Factors

- Piccadily Agro Share Price Target for 2026

- Piccadily Agro Share Price Target for 2027

- Piccadily Agro Share Price Target for 2028

- Piccadily Agro Share Price Target for 2029

- Piccadily Agro Share Price Target for 2030

- Piccadily Agro Stock Price Prediction & Investment FAQ

- About Piccadily Agro

- Piccadily Agro's Revenue Streams & Business Model

- Conclusion & Future Outlook

Should You Buy Piccadily Agro?

Key Growth Drivers

- Expansion of distillery capacities in Haryana and Chhattisgarh to meet rising domestic and international demand.

- Premium alcoholic beverage portfolio growth, led by brands like Indri, Whistler, and Camikara.

- Global expansion with the upcoming Portavadie, Scotland distillery increasing international presence.

- Strong cash flows and financial stability, enabling debt reduction and funding for strategic expansions.

- Steady domestic sugar and ethanol business, providing a stable revenue base while alco-bev drives profitability.

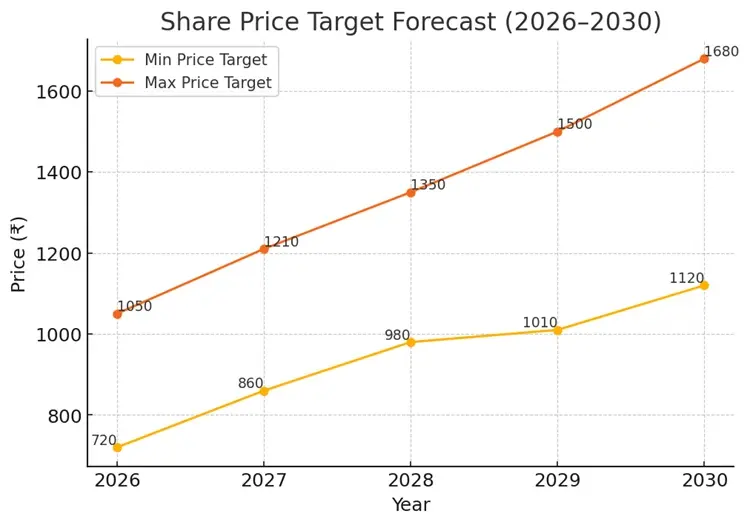

Year-wise Share Price Targets (2026-2030)

| Year | Min Price (₹) | Max Price (₹) |

|---|---|---|

| 2026 | 720 | 1,050 |

| 2027 | 860 | 1,210 |

| 2028 | 980 | 1,350 |

| 2029 | 1,010 | 1,500 |

| 2030 | 1,120 | 1,680 |

Piccadily Agro Stock Forecast Summary

Piccadily Agro shows a stable long-term outlook supported by strong distillery and sugar operations, expanding premium alcoholic beverage portfolio, ongoing capex and capacity expansion projects, and a growing international presence.

Projected Share Price Range (2026–2030):

- Min Range: ₹720 – ₹1,120

- Max Range: ₹1,050 – ₹1,680

Investment Calculator

₹0.00 Present Value: ₹0.00 Total Interest: ₹0.00 Future Value: ₹0.00Investment Calculator

Strategic Risks & SWOT – Piccadily Agro

Strengths

- Strong distillery and sugar operations with premium alcoholic beverage portfolio

- Leading single malt brand Indri with 30%+ market share in India

- Expanding manufacturing and storage capacity (Haryana, Chhattisgarh, Scotland)

- Wide geographic presence: domestic across 21 states, exports to 25 countries

- Promoter backing with strategic vision and industry experience

Weaknesses

- High valuation multiples (P/E ~56.5, P/B ~7.7)

- No dividend payout, despite consistent profits

- Working capital days increasing, affecting liquidity

- Dependence on seasonal sugarcane production impacting sugar segment revenue

Opportunities

- Distillery expansion driving revenue from domestic and international markets

- Growth in premium alcoholic beverage segment and new product launches

- Rising demand for ethanol and ENA in India

- Global expansion through Portavadie, Scotland and international exports

Threats

- Volatility in sugarcane prices and raw material availability

- Regulatory changes in alcohol or sugar industry

- Competition from other domestic and global beverage players

- Operational risks in ongoing capex and international projects

Piccadily Agro Share Price Target for 2026

Key Growth Factors for 2026

- Strong revenue growth driven by Indri and expanding premium whisky portfolio.

- Completion of Phase 1 distillery expansion expected to lift volumes and margins.

- Shift toward alco-bev (high-margin) reducing dependency on sugar seasonality.

- Increasing export footprint across 25+ countries supporting brand visibility.

- Expected improvement in quarterly EPS as alcoholic beverage mix grows.

| Month | Min Target (₹) | Max Target (₹) |

|---|---|---|

| January | 720 | 860 |

| February | 725 | 875 |

| March | 730 | 890 |

| April | 740 | 900 |

| May | 750 | 915 |

| June | 760 | 930 |

| July | 770 | 945 |

| August | 780 | 960 |

| September | 790 | 975 |

| October | 800 | 990 |

| November | 810 | 1,010 |

| December | 825 | 1,030 |

Piccadily Agro 2026 Share Price Outlook

Based on current fundamentals, brand momentum, margin expansion, and industry growth, the Piccadily Agro share price target for 2026 is estimated between:

₹720 (bearish scenario) – ₹1,030 (bullish scenario)

- Bearish assumes slower revenue growth and market volatility.

- Bullish assumes full execution of capex expansion, strong alco-bev demand, and sustained premium brand traction.

Piccadily Agro Share Price Target for 2027

Key Growth Factors for 2027

- Expected revenue boost from the Chhattisgarh greenfield distillery (210 KLPD) beginning partial operations.

- Higher contribution from premium alcoholic beverages (Indri, Camikara) improving overall margins.

- Growing export penetration helping diversify revenue beyond domestic markets.

- Improved operating leverage as expanded capacities start generating consistent cash flows.

| Year | Min Price (₹) | Max Price (₹) |

|---|---|---|

| 2027 | ₹860 | ₹1,210 |

Piccadily Agro 2027 Share Price Outlook

Based on expansion-led earnings growth, premium brand traction, and overall industry trends, the Piccadily Agro share price target for 2027 is estimated between:

₹860 (bearish scenario) – ₹1,210 (bullish scenario)

- Bearish scenario: Assumes slower-than-expected revenue growth, higher working capital pressure, or delayed commissioning of new capacities.

- Bullish scenario: Assumes strong alco-bev demand, full benefit of capex expansion, and rising global presence of premium brands.

Piccadily Agro Share Price Target for 2028

Key Growth Factors for 2028

- Full operational benefits from both the Indri (Haryana) expansion to 250 KLPD and the Chhattisgarh 210 KLPD distillery, significantly boosting production capacity.

- Strong scaling of premium alco-bev brands (Indri, Whistler, Camikara) enhancing margins and brand equity.

- Increased export sales as the company strengthens presence in 25+ countries and potentially enters new markets.

- Better operating leverage and declining debt pressure as expanded plants begin contributing to profit.

| Year | Min Price (₹) | Max Price (₹) |

|---|---|---|

| 2028 | ₹980 | ₹1,350 |

Piccadily Agro 2028 Share Price Outlook

Based on expanded distillery capacity, rising alco-bev margins, strong brand momentum, and improving export contribution, the Piccadily Agro share price target for 2028 is estimated between:

₹980 (bearish scenario) – ₹1,350 (bullish scenario)

- Bearish scenario: Assumes moderate growth, volatility in sugar and ethanol pricing, or slower international traction.

- Bullish scenario: Assumes strong demand for premium spirits, full utilization of expanded capacities, and continued premiumization of revenue mix.

Piccadily Agro Share Price Target for 2029

Key Growth Factors for 2029

- Full ramp-up of both domestic distilleries and initial production from the international distillery in Portavadie, Scotland, supporting global premium brand expansion.

- Continued premiumization of alcoholic beverage portfolio driving higher operating margins.

- Stable domestic sugar business contributing to steady base revenue while alco-bev dominates growth.

- Strong cash flows enabling debt reduction, supporting long-term financial stability.

| Year | Min Price (₹) | Max Price (₹) |

|---|---|---|

| 2029 | ₹1,010 | ₹1,500 |

Piccadily Agro 2029 Share Price Outlook

Considering ongoing capacity expansions, international brand presence, and rising premium alco-bev margins, the Piccadily Agro share price target for 2029 is estimated between:

₹1,010 (bearish scenario) – ₹1,500 (bullish scenario)

- Bearish scenario: Assumes slower adoption of premium brands, operational delays, or global economic slowdown.

- Bullish scenario: Assumes strong international and domestic demand, continued margin expansion, and fully operational expanded capacities.

Piccadily Agro Share Price Target for 2030

Key Growth Factors for 2030

- Full-scale operations of all distilleries, including Portavadie, Scotland, establishing Piccadily Agro as a global premium spirits player.

- Matured premium alcoholic beverage portfolio (Indri, Whistler, Camikara) contributing significant high-margin revenue.

- Consistent cash flows enabling sustained debt reduction and funding for smaller strategic expansions.

- Stable domestic sugar and ethanol business providing a reliable revenue base while alco-bev drives profitability.

| Year | Min Price (₹) | Max Price (₹) |

|---|---|---|

| 2030 | ₹1,120 | ₹1,680 |

Piccadily Agro 2030 Share Price Outlook

With all expansions in full operation, strong brand equity, and continued premiumization of products, the Piccadily Agro share price target for 2030 is estimated between:

₹1,120 (bearish scenario) – ₹1,680 (bullish scenario)

- Bearish scenario: Assumes slower adoption in global markets, macroeconomic headwinds, or margin pressures in alcoholic beverages.

- Bullish scenario: Assumes strong global brand traction, premium product growth, and efficient utilization of all distillery capacities.

About Piccadily Agro

Founded: 1994

Headquarters: Indri, Haryana, India

Website:www.picagro.com

Overview:

Piccadily Agro Industries Ltd (PAIL) is a prominent Indian agro-processing and alcoholic beverage company, specializing in sugar manufacturing, ethanol/ENA production, and premium alcoholic beverages. The company started as a sugar processing firm and has steadily expanded into the distillery and spirits sector, establishing itself as a key player in India’s alcoholic beverage market.

Key Focus:

- Distillery & Premium Alcoholic Beverages: Producer of leading brands such as Indri (single malt whisky), Whistler, Royal Highland, and Camikara rum.

- Sugar & Ethanol Operations: Produces crystal white sugar and ethanol, ensuring a steady revenue base alongside the growing distillery segment.

- Domestic & International Reach: Operates across 21 Indian states with exports to 25 countries, including Australia, USA, Germany, Japan, and Nepal.

- Capacity Expansion: Ongoing projects include scaling distillery capacity in Haryana and Chhattisgarh and establishing its first international distillery in Portavadie, Scotland.

Mission:

Piccadily Agro aims to deliver high-quality agro-products and premium alcoholic beverages while expanding its domestic and global presence, focusing on sustainable growth and brand leadership in the alcohol and sugar industries.

How Piccadily Agro Makes Money

Piccadily Agro Industries Ltd generates revenue through multiple business segments focused on sugar, ethanol, and alcoholic beverages:

- Sugar Production:

The company manufactures crystal white sugar from sugarcane, supplying to both domestic and international markets. Sugar sales provide a stable revenue base, although seasonal fluctuations affect output. - Distillery & Alcoholic Beverages:

A major growth driver, this segment includes premium brands like Indri (single malt whisky), Whistler, Royal Highland, and Camikara rum. Revenue comes from sales of country liquor, ENA (Extra Neutral Alcohol), ethanol, and premium spirits, with high margins from branded alcoholic beverages. - Ethanol & ENA Sales:

Piccadily Agro produces ethanol for blending with petrol under government mandates, and ENA for industrial and beverage use. This segment provides a steady income and benefits from government incentives for biofuels. - Domestic & International Markets:

While 95% of revenue comes from India, the company exports to 25 countries, including the USA, Australia, Germany, Japan, and Nepal, helping diversify its income streams.

Piccadily Agro Key Highlights

🍬 Revenue Mix: Sugar (33%), Premium Alcohol & B2B Malts (38%), Country Liquor (24%), Ethanol/ENA (5%)

🏭 Manufacturing Footprint: Sugar and distillery plant in Indri, Haryana, with expansion projects underway in Chhattisgarh and Scotland

🌍 Global Reach: Exports and international distillery expansion enhance brand visibility

📈 Growth Drivers: Rising demand for premium alcoholic beverages, government ethanol mandates, and capacity expansion plans

Conclusion & Future Outlook

Piccadily Agro Industries Ltd is growing its presence in sugar, ethanol, and alcoholic beverages, with a strong focus on premium spirits and distillery expansion.

The company’s growth is supported by rising demand, brand strength, and capacity expansion, while seasonal sugar fluctuations, regulatory risks, and high capex remain key challenges.

Overall, Piccadily Agro has a solid foundation for long-term growth, but investors should weigh both opportunities and risks when considering the stock.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial advice. The content is based on publicly available data, and while we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information. Always consult with a qualified financial advisor or professional before making any investment or financial decisions.

Leave a comment

Your email address will not be published. Required fields are marked *