Reliance Power has established itself as a key player in India's energy sector, with a focus on power generation, distribution, and renewable energy projects. For investors keeping an eye on the energy market, the key questions are: Is Reliance Power a good investment? What are its share price targets for the next five years?

In this article, we dive into Reliance Power’s business model, financial health, market position, risks, and future growth prospects. We also provide data-driven forecasts for the company's share price through 2026 and 2030, helping you make informed investment decisions.

Table of Contents

- Should You Buy Reliance Power?

- Reliance Power Stock Price Forecast: 2026–2030

- Interactive Investment Calculator

- SWOT Analysis & Risk Factors

- Reliance Power Share Price Target for 2026

- Reliance Power Share Price Target for 2027

- Reliance Power Share Price Target for 2028

- Reliance Power Share Price Target for 2029

- Reliance Power Share Price Target for 2030

- Reliance Power Stock Price Prediction & Investment FAQ

- About Reliance Power

- Reliance Power's Revenue Streams & Business Model

- Conclusion & Future Outlook

Should You Buy Reliance Power?

Key Growth Factors:

- Commissioning of hydroelectric projects (~3438 MW) across Arunachal Pradesh, Himachal Pradesh, and Uttarakhand.

- Operationalization of renewable energy projects (solar & wind) boosting clean energy capacity.

- Progress in international projects, including Bangladesh Meghnaghat 718 MW gas power plant.

- Gradual reduction in debt and improved interest coverage, strengthening financial stability.

- Rising domestic electricity demand and favorable government policies for power sector growth.

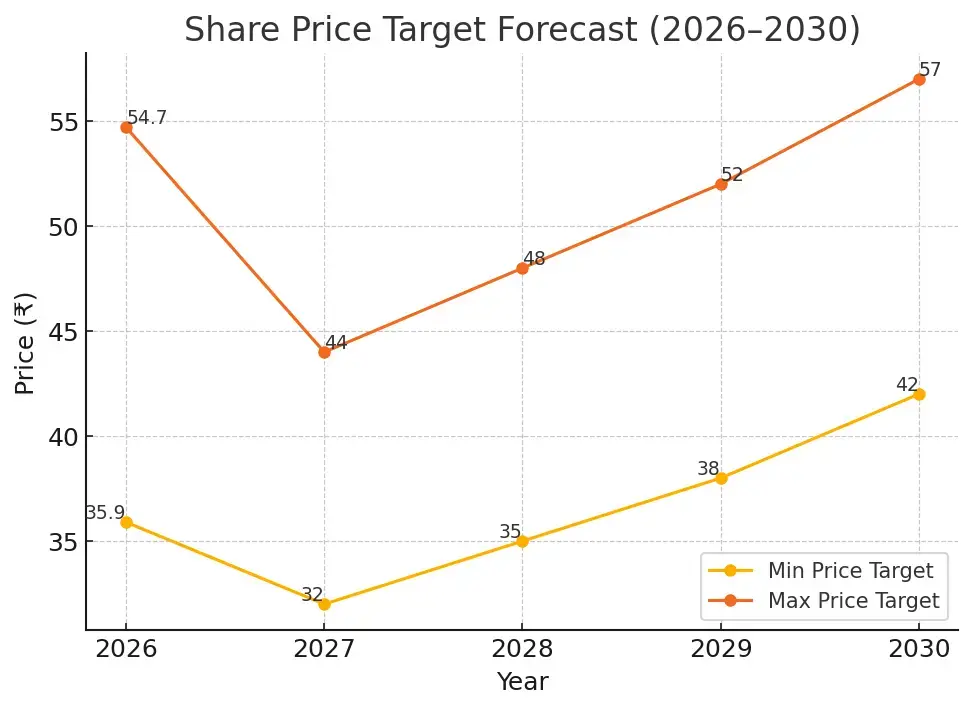

| Year | Min | Max |

|---|---|---|

| 2026 | ₹35.90 | ₹54.70 |

| 2027 | ₹32 | ₹44 |

| 2028 | ₹35 | ₹48 |

| 2029 | ₹38 | ₹52 |

| 2030 | ₹42 | ₹57 |

Reliance Power Stock Forecast Summary

Reliance Power shows a stable long-term outlook supported by strong thermal and renewable capacity, major operational projects, hydro expansion, and strategic international presence.

Min Range (2026–2030): ₹32 – ₹42

Max Range (2026–2030): ₹44 – ₹57

Investment Calculator

₹0.00 Present Value: ₹0.00 Total Interest: ₹0.00 Future Value: ₹0.00Investment Calculator

Strategic Risks & SWOT – Reliance Power

Strengths

- Large thermal and renewable power generation capacity (5,945 MW)

- Operational mega projects like Sasan UMPP and Rosa plant

- Growing hydroelectric portfolio in India

- Strong promoter backing and strategic international presence

Weaknesses

- High debt levels (Debt-to-Equity ~0.92)

- Low return on equity (-1.08%) and moderate profitability

- Non-operational projects and regulatory delays

Opportunities

- Expansion in renewable energy (solar, wind, hydro)

- International projects, e.g., Bangladesh gas-based plant

- Rising electricity demand in India and neighboring regions

- Government incentives for clean energy and infrastructure

Threats

- Regulatory and environmental risks affecting projects

- Fuel supply volatility (coal/gas imports)

- Competition from other power producers in India and abroad

- Interest rate fluctuations impacting financing costs

Reliance Power Share Price Target for 2026

Key Growth Factors for 2026

- Stable performance of major thermal plants (Sasan UMPP, Rosa) providing steady revenue.

- Debt reduction and improving cash flow, which strengthens financial health.

- Progress on hydro and Bangladesh gas projects, adding future capacity and earnings potential.

- Rising electricity demand in India, supporting higher generation and profitability.

| Month | Min | Max |

|---|---|---|

| January | ₹38.50 | ₹49.20 |

| February | ₹39.10 | ₹50.40 |

| March | ₹37.80 | ₹48.10 |

| April | ₹36.90 | ₹47.50 |

| May | ₹38.20 | ₹49.80 |

| June | ₹37.30 | ₹48.90 |

| July | ₹35.90 | ₹47.10 |

| August | ₹38.50 | ₹50.20 |

| September | ₹39.00 | ₹51.80 |

| October | ₹38.80 | ₹52.50 |

| November | ₹40.10 | ₹53.20 |

| December | ₹41.00 | ₹54.70 |

Based on current fundamentals and industry outlook, the Reliance Power share price target for 2026 is estimated between ₹35.90 (bearish) and ₹54.70 (bullish).

Reliance Power Share Price Target for 2027

Key Growth Factors for 2027:

- Commissioning of hydroelectric projects (~3438 MW) boosting generation capacity.

- Progress in Bangladesh Meghnaghat 718 MW gas power plant with potential PPAs.

- Gradual reduction in debt improving interest coverage.

- Rising domestic electricity demand supporting revenue growth.

| Year | Min Price | Max Price |

|---|---|---|

| 2027 | ₹32 | ₹44 |

Based on current fundamentals and industry outlook, the Reliance Power share price target for 2027 is estimated between ₹32 (bearish) and ₹44 (bullish).

Reliance Power Share Price Target for 2028

Key Growth Factors for 2028:

- Operationalization of more renewable energy projects, including wind and solar.

- Improved financial health with lower debt-to-equity ratio.

- Stabilization of non-operational coal projects or potential cancellations.

- Government policies supporting power sector expansion and renewable energy incentives.

| Year | Min Price | Max Price |

|---|---|---|

| 2028 | ₹35 | ₹48 |

Based on current fundamentals and industry outlook, the Reliance Power share price target for 2028 is estimated between ₹35 (bearish) and ₹48 (bullish).

Reliance Power Share Price Target for 2029

Key Growth Factors for 2029:

- Full-scale hydroelectric and renewable projects contributing to steady cash flows.

- Potential long-term PPAs from international projects (Bangladesh).

- Efficiency improvements in thermal plants reducing costs.

- Continued rise in electricity demand across India.

| Year | Min Price | Max Price |

|---|---|---|

| 2029 | ₹38 | ₹52 |

Based on current fundamentals and industry outlook, the Reliance Power share price target for 2029 is estimated between ₹38 (bearish) and ₹52 (bullish).

Reliance Power Share Price Target for 2030

Key Growth Factors for 2030:

- Diversified energy mix (thermal + hydro + renewables) driving stable revenues.

- Reduction in legacy project risks and completed operational upgrades.

- Strategic partnerships and investments enhancing financial and operational strength.

- India’s continued power consumption growth and renewable energy targets.

| Year | Min Price | Max Price |

|---|---|---|

| 2030 | ₹42 | ₹57 |

Based on current fundamentals and industry outlook, the Reliance Power share price target for 2030 is estimated between ₹42 (bearish) and ₹57 (bullish).

About Reliance Power

Founded: 2007

Founder: Anil Ambani

Headquarters: Mumbai, Maharashtra, India

Website:www.reliancepower.co.in

Overview:

Reliance Power Ltd is one of India’s leading private power generation companies, engaged in developing, constructing, and operating power projects across India and internationally. The company has a diversified portfolio of thermal, hydroelectric, and renewable energy projects, with a total installed capacity of 5,945 MW. Reliance Power has been a key player in India’s energy sector, focusing on both conventional and clean energy sources.

Key Focus:

- Thermal & Renewable Energy: Reliance Power operates major coal-based thermal projects as well as solar, wind, and hydroelectric plants.

- International Expansion: Developing projects abroad, including a gas-based power plant in Bangladesh.

- Sustainable Growth: Focused on renewable energy and clean power initiatives to meet India’s growing electricity demand.

- Mega Projects: Operates large-scale projects like Sasan UMPP (3,960 MW) and Rosa Thermal Plant (1,200 MW).

Mission:

Reliance Power aims to provide reliable and sustainable energy solutions to fuel India’s growth while expanding its global presence in the power sector.

How Reliance Power Makes Money

Reliance Power generates revenue from several key business segments:

- Power Generation: The core revenue comes from generating electricity through thermal (coal-based), hydro, and renewable (solar & wind) projects. Major plants include Sasan Ultra Mega Power Plant (3,960 MW) and Rosa Thermal Plant (1,200 MW).

- Power Sale Contracts: Revenue is earned via long-term power purchase agreements (PPAs) with government utilities and private companies.

- Renewable Energy Projects: Reliance Power is investing in solar and wind energy projects, tapping India’s growing clean energy market.

- International Operations: The company earns from overseas projects, including gas-based and renewable power plants in Bangladesh and other regions.

- Infrastructure Development: In some cases, Reliance Power earns from developing and operating power infrastructure for private and public clients.

Reliance Power Key Highlights

- ⚡ Total Installed Capacity: ~6,100 MW across India

🏭 Major Plants: Sasan UMPP, Rosa Thermal, Krishnapatnam, and expanding renewable projects

🌱 Renewable Energy Focus: Increasing solar & wind capacity to align with India’s net-zero goals

💹 Revenue Model: Long-term PPAs with government and private clients ensure stable cash flow

🌍 Geographic Reach: Primarily India, with selective overseas renewable projects

📈 Growth Focus: Expansion into clean energy and modernization of thermal plants

Conclusion & Future Outlook

Reliance Power is evolving by expanding its energy portfolio, focusing on thermal power, renewable energy, and long-term power purchase agreements (PPAs) that ensure steady cash flow. With a strong emphasis on sustainability and clean energy, Reliance Power is positioning itself as a key player in India’s growing power sector.

The company’s ongoing investments in solar and wind projects, modernization of thermal plants, and strategic expansion across India set the stage for continued growth and strengthen its role in shaping the country’s energy future.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial advice. The content is based on publicly available data, and while we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information. Always consult with a qualified financial advisor or professional before making any investment or financial decisions.

Leave a comment

Your email address will not be published. Required fields are marked *